Warren Buffett Wealth, often hailed as the “Oracle of Omaha,” is one of the most successful and admired investors of all time. With a net worth of over $130 billion as of 2025, Buffett’s journey from selling chewing gum door-to-door to becoming the 5th richest person in the world is nothing short of extraordinary.

But how is Warren Buffett so rich? What are the principles that powered his wealth? And what can everyday investors learn from his iconic journey?

In this in-depth blog post, we break down the wealth of Warren Buffett, explore the 70/30 rule, the five golden rules of investing he follows, and understand at what age Warren Buffett got rich.

📊 A Snapshot of Warren Buffett Wealth

-

Net Worth (2025): $130+ Billion

-

Main Company: Berkshire Hathaway Inc.

-

Age: 94

-

Occupation: Chairman and CEO of Berkshire Hathaway

-

Annual Return Record: ~20% compounded annual growth for over 50 years

-

Philanthropy: Committed to giving away 99% of his wealth

💡 How is Warren Buffett So Rich?

Warren Buffett’s wealth is built on a few key principles that seem deceptively simple but require a lifetime of discipline, patience, and rational thinking.

1. Compound Interest Over Time

Buffett began investing at age 11 and purchased his first stock at that age. By age 30, he had already accumulated nearly $1 million (adjusted for inflation). Over decades, his investments compounded at remarkable rates.

2. Buying Businesses, Not Just Stocks

Rather than betting on stock prices, Buffett buys entire businesses or large controlling stakes in companies he understands—such as Coca-Cola, Apple, and American Express.

3. Living Below His Means

Despite being a billionaire, Buffett still lives in the modest Omaha home he bought in 1958 for $31,500. His frugal lifestyle helped him retain capital for investments.

🧠 What is the 70/30 Rule Buffett?

Although Buffett hasn’t explicitly endorsed a “70/30 Rule,” it’s often attributed to his general investing philosophy. Here’s what it generally means in Buffett-style wealth management:

70% of your capital should be invested in equities (stocks), while 30% remains in safer assets (like bonds or cash).

Buffett has often advised ordinary investors to:

-

Invest 90% in a low-cost S&P 500 index fund

-

Keep 10% in short-term government bonds

This reflects his belief in the power of equities over time, while maintaining a safety cushion.

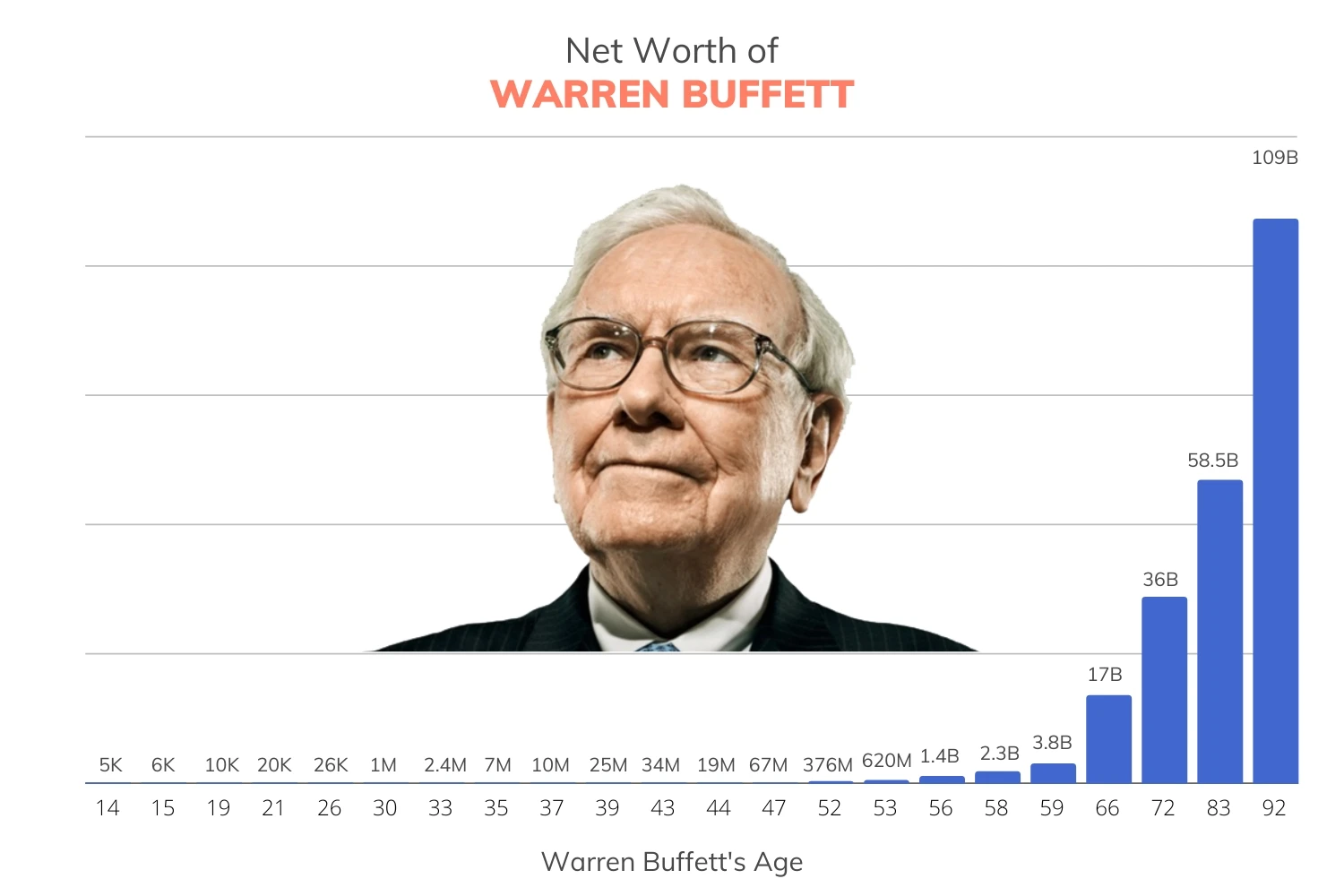

🧓 At What Age Did Warren Buffett Get Rich?

Buffett’s journey to wealth was gradual, not instant.

| Age | Net Worth Milestones |

|---|---|

| 11 | Bought first stock |

| 30 | Became a millionaire |

| 56 | Became a billionaire in 1986 |

| 60+ | Wealth began accelerating rapidly |

| 90s | Net worth surpassed $100 billion |

Buffett often jokes:

“I always knew I’d be rich. I never doubted it for a minute.”

But he achieved the bulk of his wealth after the age of 60, thanks to the power of compounding.

📈 Warren Buffett’s 5 Rules of Investing

1. Never Lose Money

This is Buffett’s most famous rule. Preservation of capital is paramount. Speculative investments are avoided at all costs.

2. Invest in What You Understand

Buffett only invests in companies he fully comprehends. This means avoiding complexity and staying within his circle of competence.

3. Look for Economic Moats

He seeks companies with durable competitive advantages—brands, pricing power, low-cost operations—that protect profits long-term.

4. Be Greedy When Others Are Fearful

Buffett is a contrarian investor. He often buys undervalued stocks during downturns when most investors panic.

5. Long-Term Perspective

Buffett’s average holding period is “forever.” He invests with a long horizon, ignoring short-term volatility.

🏢 How Buffett Built Berkshire Hathaway’s Empire

Major Holdings in 2025:

-

Apple Inc. – $150+ billion stake

-

Coca-Cola – Over 9% ownership

-

American Express – Major long-term holding

-

Chevron and Occidental Petroleum – Large energy bets

-

Geico – Berkshire-owned insurance company

Berkshire Hathaway is not just a stock holding company—it owns dozens of wholly-owned businesses including:

-

BNSF Railway

-

Duracell

-

Dairy Queen

-

See’s Candies

-

Nebraska Furniture Mart

Buffett’s model is a blend of value investing, private equity, and insurance float management—a sophisticated financial architecture few have replicated.

🌍 Philanthropy: The Giving Pledge

In 2006, Buffett made history by pledging to donate 99% of his fortune to charitable causes, largely via the Bill & Melinda Gates Foundation.

He has already donated over $50 billion, making him the most generous philanthropist in modern history.

🧾 What Investors Can Learn from Warren Buffett

📌 2 Key Takeaways:

✅ Long-Term Focus Pays Off

Buffett’s wealth was built slowly, not overnight. Time in the market is more powerful than timing the market.

✅ Keep It Simple

Avoid overcomplicating your portfolio. Use index funds, focus on value, and invest in businesses you understand.

🔚 Final Thoughts: Buffett’s Wealth Is Wisdom in Action

Warren Buffett’s wealth is a result of discipline, rational decision-making, frugality, and a deeply ingrained belief in long-term value creation. Whether you’re just starting your investment journey or are well on your way, Buffett’s timeless principles can serve as a compass in the world of finance.

He’s not just rich because of the money he made—but because of the wisdom with which he kept and grew it.

🔗 Reference URLs

-

https://www.cnbc.com/2023/06/25/warren-buffetts-5-rules-of-investing.html

-

https://www.businessinsider.com/warren-buffett-investing-strategy-advice-philosophy-2023-12

📬 If you have any additional information, suggestions, or credits related to this content, please let us know to improve and provide better insights. Also, If you have any queries or copyright concerns, please contact us at prowealthexpert@gmail.com.

3 responses

This is very usefull